Stay on top of changes to the SECURE Act.

Changes Made By the SECURE Act That May Affect You:

- “Stretch Out” IRA’s have been eliminated for non-spousal beneficiaries.

- Non-spousal beneficiaries must take their entire distributions within 10 years.

- For those born after July 1, 1949, Required Minimum Distributions (RMD) now begin when you turn 72.

Not Changed by the SECURE Act:

- For those already 70-1/2 before SECURE, RMD rules remain the same, i.e., began at 70-1/2.

- Surviving spouse can still “stretch out” payments over his or her lifetime.

- Qualified Charitable Distributions (QCD’s) can still be made beginning at age 70-1/2.

- To leave part of your qualified retirement account to one or more charities and individual beneficiaries, you may split your account into separate IRA accounts for that purpose.

Retirement Gift Planning Scenarios

Mark and Livy are approaching their 70’s and looking ahead to their retirement years. They talk with their financial advisor about how to best balance their objectives:

- Ensure sufficient access to future income when needed, but at lowest tax cost possible.

- Leave an appropriate amount for individual heirs.

- Continue giving to their favorite charities both now and in the future.

They learn that their $1.5million 401k account will obligate the taxable withdrawal of up to $1.3 million in RMD within their first 15 years of retirement. Mark and Livy will choose an approach that they feel works best for them. Your approach may differ from theirs, but it can be significant all the same. They also realize that QCD’s can only be made from IRA accounts, and can only offset RMD from IRA’s.

After reviewing various options with their tax advisor, they are able to decide on how much income they may need from the 401k, and decide to roll over an appropriate percentage of that 401k to a separate traditional IRA account. The dedicated IRA account will be used to make QCD’s to offset up to $100,000 each year of RMD associated with that IRA account.

With two separate retirement accounts, they will now be able to use one account to make beneficiary designations to the individual heirs and the other to make their charitable arrangements.

Knowing that these plans can be easily changed, they plan to work with their advisor to establish a trust document for a Charitable Remainder Unitrust (CRUT) which can be either initiated upon death (Testamentary) or funded during their lifetimes and supplemented by designation from either retirement plan account upon their passing.

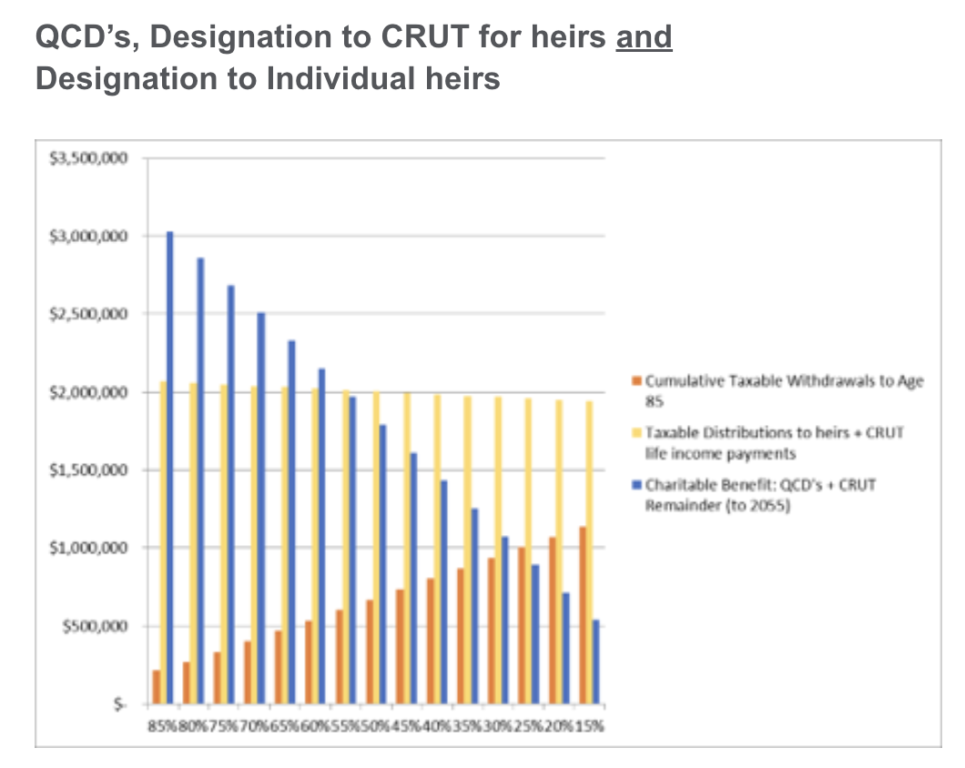

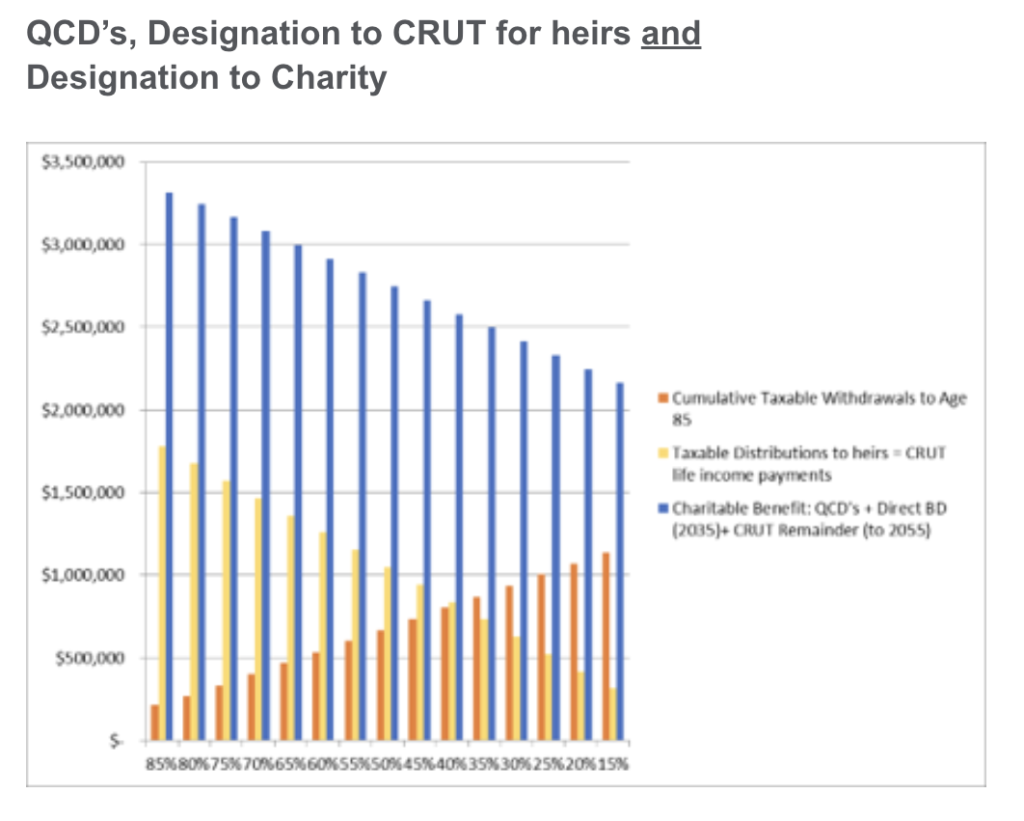

Here are just two of the possibilities they have considered: (In each scenario below, any percentage split from the main account to an IRA will result in differing combinations of taxable withdrawals, taxable distributions to heirs, and charitable benefits.)

Talk to a member of our Planned Gifts team.

ConnectThoughtful planning now.

Your thoughtful planning now can help you achieve your objectives, address various planning issues and concerns, and generate a substantial charitable benefit during your lifetime—and beyond—while still taking care of the people you love, and the charitable missions that are most deserving of your heartfelt support.

While we cannot provide you with legal or tax advice, we would very much like to help you shape the future for Hartford Hospital. Let’s have a conversation about your intentions so we can find a way to ensure an outcome that will make you proud, the future brighter, and our community all the more grateful.

Contact Us

Rob Keane

Senior Philanthropic Officer

Hartford Hospital

860-972-1932

robert.keane@hhchealth.org